KNOWLEDGE - EXPERIENCE - DISCIPLINE

HENRY ROLLING, PRESIDENT, CEO, CIO, CCO

Henry Rolling has earned the following degrees:

- Masters of Science in Finance

- Masters in Business Administration

- Masters of Science in Economics

- Bachelors of Economics

Rolling is a member of the BETA GAMA SIGMA Honor Society and holds a FINRA SERIES 65 License.

Professional Football

Rolling played in the National Football League (NFL) from 1987 to 1995 and started at Outside Linebacker / Defensive End for the following NFL teams:

- Tampa Bay Buccaneers

- San Diego Chargers

- Los Angeles Rams

Resource Capital Management, LLC

Rolling is the founder of Resource Capital Management, LLC and has served as the firm’s CEO and CIO since 2009. In 2009, Rolling finalized the programming and the development of the intellectual property that the firm utilizes to construct all of the firm’s long investment strategies. In addition, Rolling has developed a Market Directional Trading Model, a Complex Option Trading Model, a Long/Short Investment Trading Model and a Long/Short (Alternative Hedge) Investment Trading Model.

In 2014 Rolling managed and provided advisory services for AUM of $6 million

Rolling also serves as the firm’s Portfolio Manager and provides the following in that capacity:

- Conducts client interviews for investment advisory services.

- Utilizes the Resource Capital investment model to select stocks to be included in stock portfolios.

- Establishes and opens all brokerage accounts via the following firms:

- Submits and executes all equity and option trades for all brokerage accounts.

- Monitors and conducts portfolio risk analysis.

- Utilizes the Resource Capital investment model to rebalance stock portfolios.

Rolling serves as the firm’s Compliance Officer and provides the following in that capacity:

- Ensures that all SEC and Nevada State Securities Division statues are followed and adhered to.

- Responsible for all SEC filings including FORM ADV.

HENRY ROLLING, HEAD OF QUANTITATIVE ANALYSIS

ADVISORY BOARD

Greg Kapoustin, CFA

PERFORMANCE

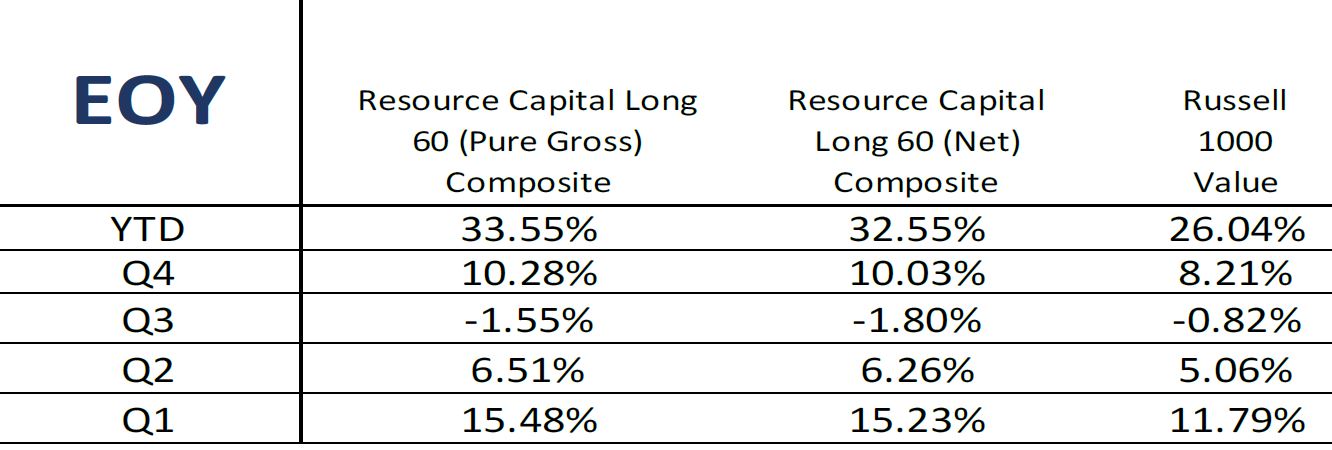

RCM Long 60

Resource Capital Equally-Weighted Long 60 Value Portfolio Composite

Please see Performance Disclosures provided at the end of this webpage.

About Resource Capital Management

Portfolio Management:

Henry Rolling, President, CEO, CIO, CCO

Benchmark: Russell 1000 Value

Firm Background: Resource Capital Management, LLC is an SEC registered investment advisor. The Company is an asset management and investment advisory company specializing in the development and management of equity security portfolios. The Company utilizes a proprietary financial model employing a unique value approach to stock selection and portfolio construction.

Objective: The Resource Capital strategy seeks to achieve capital appreciation and outperform key indices on an annual basis through value investing. Resource Capital’s slow and steady investment discipline strives to create both short-term and long-term value.

Investment Process: The Resource Capital investment process always wants to be on the side of value-to-growth. The primary objective of the Resource Capital investment model is to identify and invest in value companies before they become growth companies and to re-balance out of those growth companies into new value companies when the investment model indicates to do so.

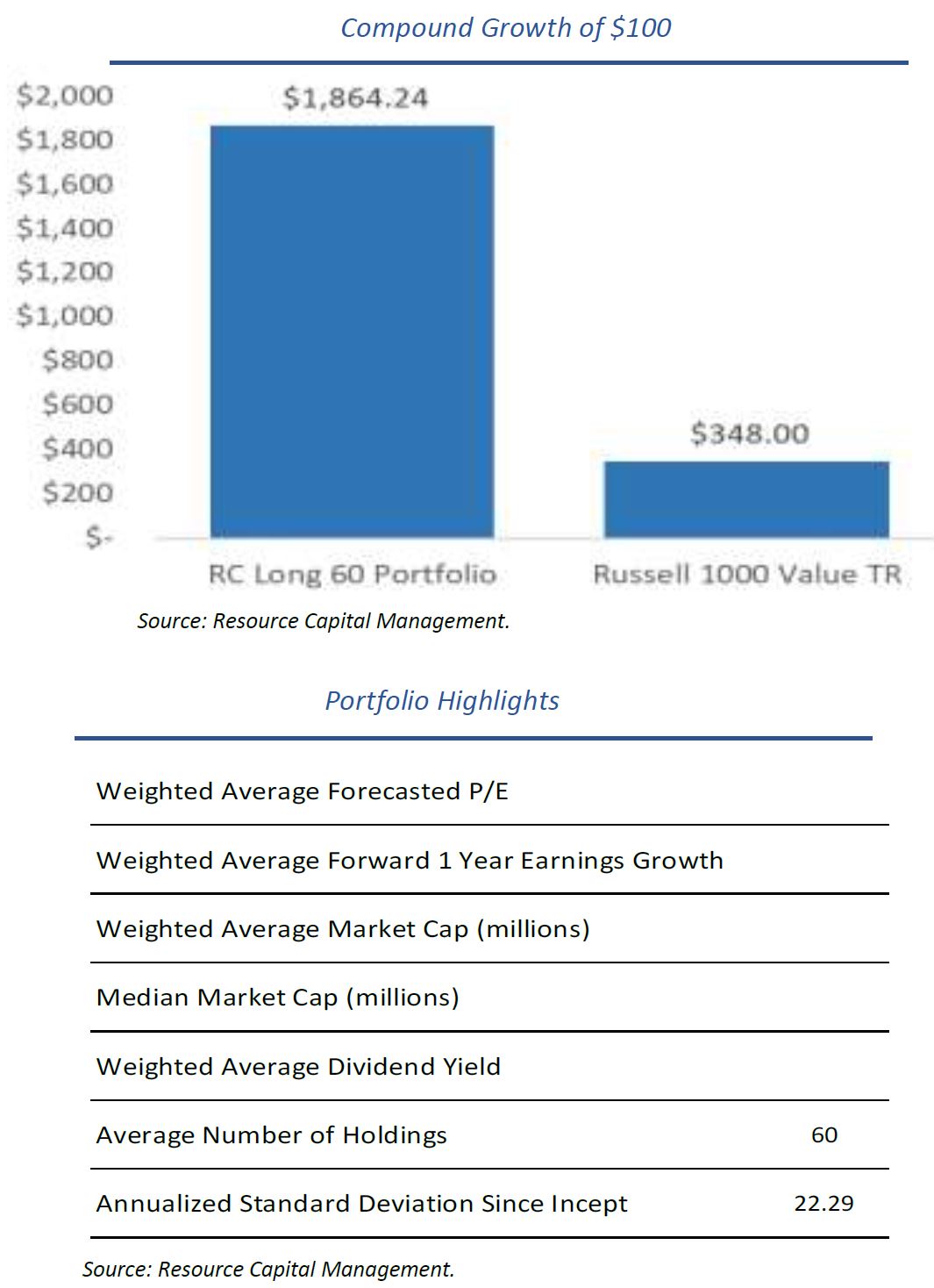

Outperformance: The Resource Capital Long

60 Portfolio is a value investing portfolio that

utilizes the Russell 1000 Value as a

comparison benchmark. The Resource

Capital Long 60 Portfolio has outperformed

the Russell 1000 Value on a cumulative basis

since its’ inception. As the composition of

comparison benchmarks change overtime,

Resource Capital can adjust universal

limitations and financial factors in order to

construct portfolios that can potentially

outperform the Russell 1000 Value, the S&P

500, and other relevant indices on an annual

and cumulative basis.

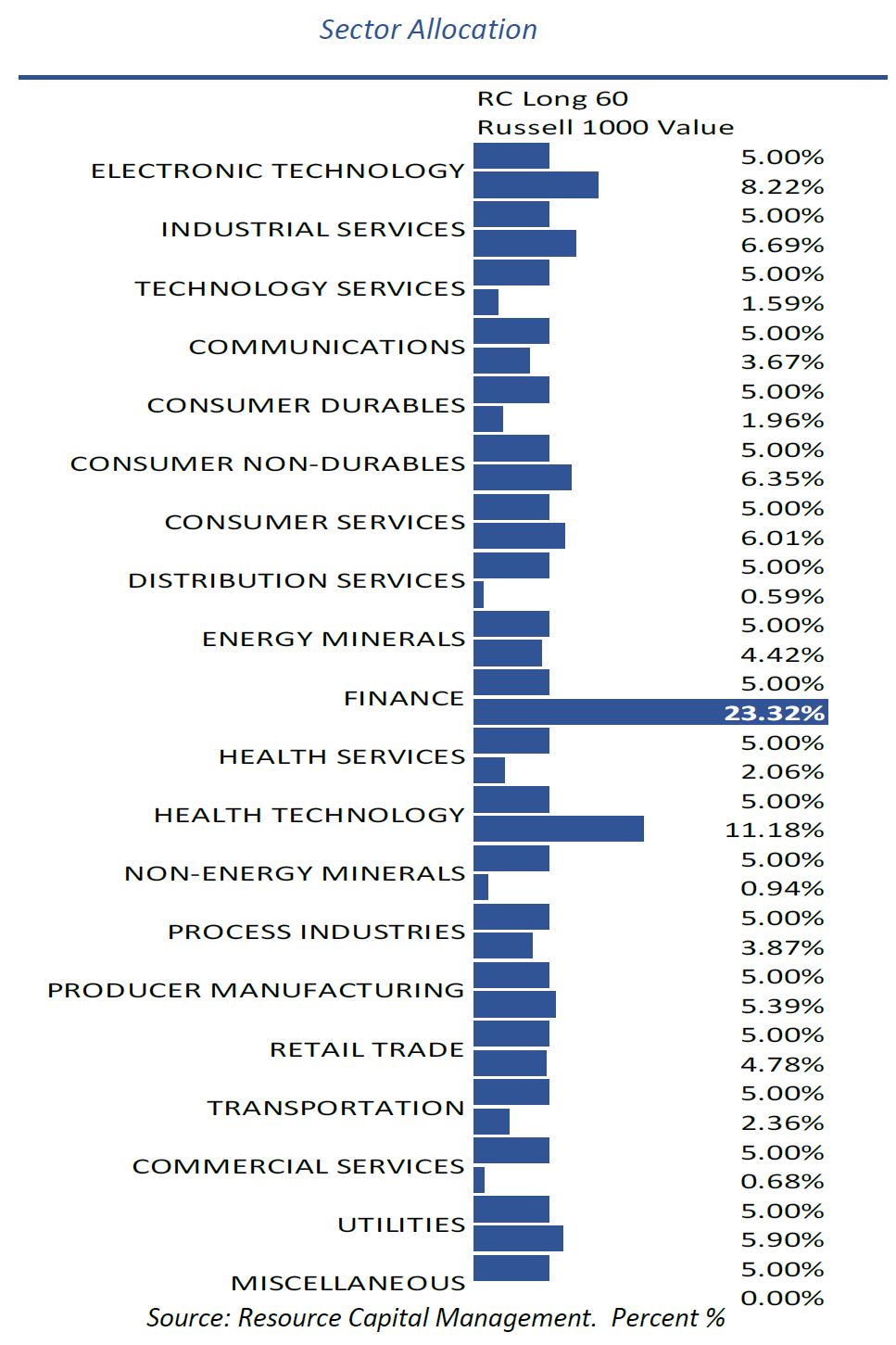

The Resource Capital Equally Weighted Long 60 Value Portfolio is comprised of 60 stocks. Investment capital is allocated on an equally weighted basis across constituents and economic sectors.

Resource Capital’s core belief hinges on the notion that improving operating metrics which deliver profitability and balance sheet improvements will ultimately be rewarded by the market over time. Resource Capital strives to create both short term and long term returns while mitigating risk as much as possible via asset allocation across stocks and economic sectors. Through testing and algorithmic construction of the Resource Capital Equally Weighted Long 60 Value Portfolio, Resource Capital seeks to outperform comparison and relevant benchmarks on an annual basis. Additionally, the low level of turnover and tax sensitivity in the portfolio re-balancing process may assist in generating a better performance outcome for taxable clients.

Source: Resource Capital Management

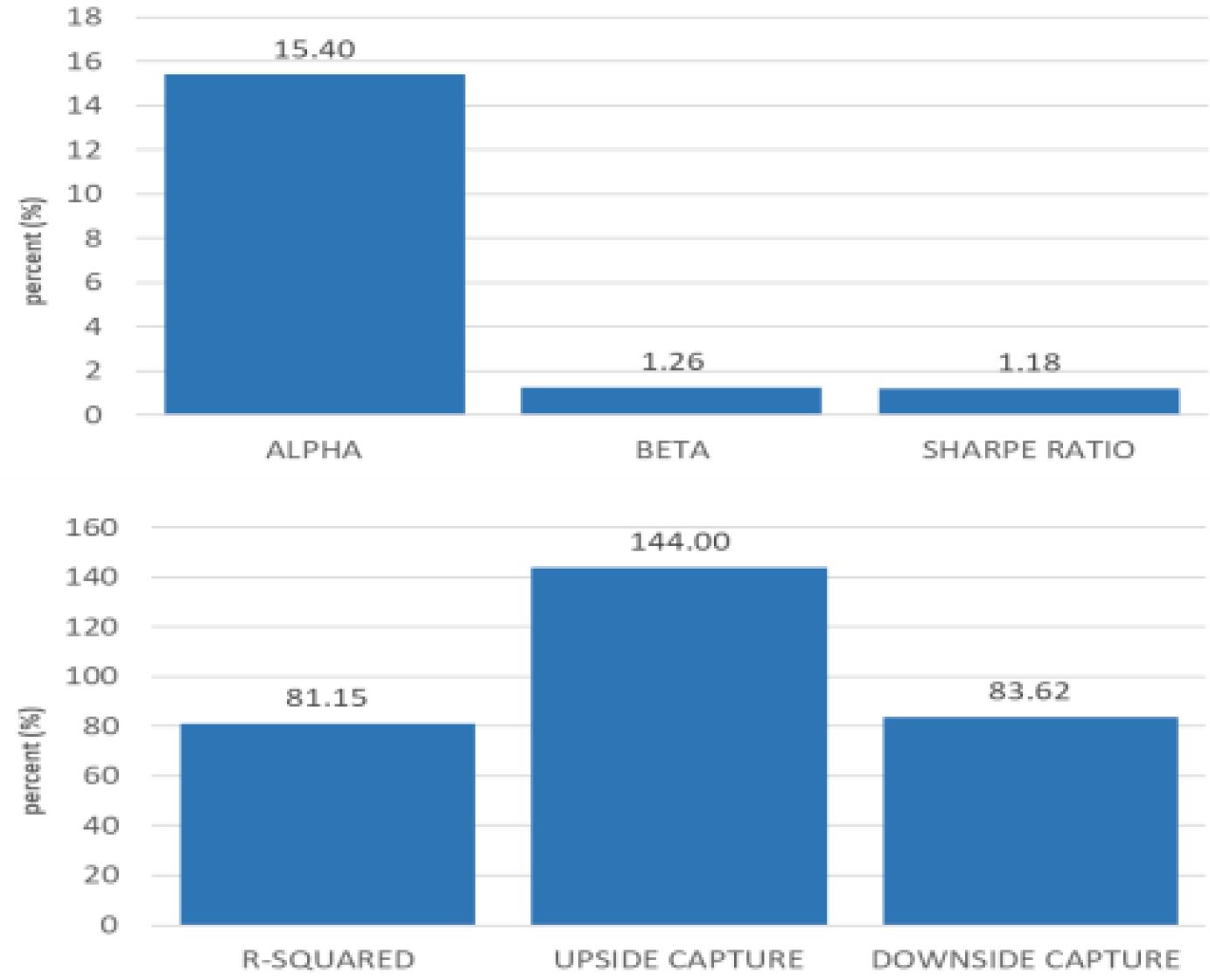

Return/Risk Analysis Supplemental Information

RC Long 60 Value (Pure Gross) 1/1/2009 to 12/31/2021

Source: Resource Capital Management

Return/Risk statistics are calculated versus the Russell 1000 Value Index. The graphs above are for illustrative purposes only. Past performance does not guarantee future results. Investments in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. None of the stock information, data and company information presented herein constitutes a recommendation by Resource Capital Management or a solicitation of any offer to buy or sell any securities. See important disclosures at the end of this document.

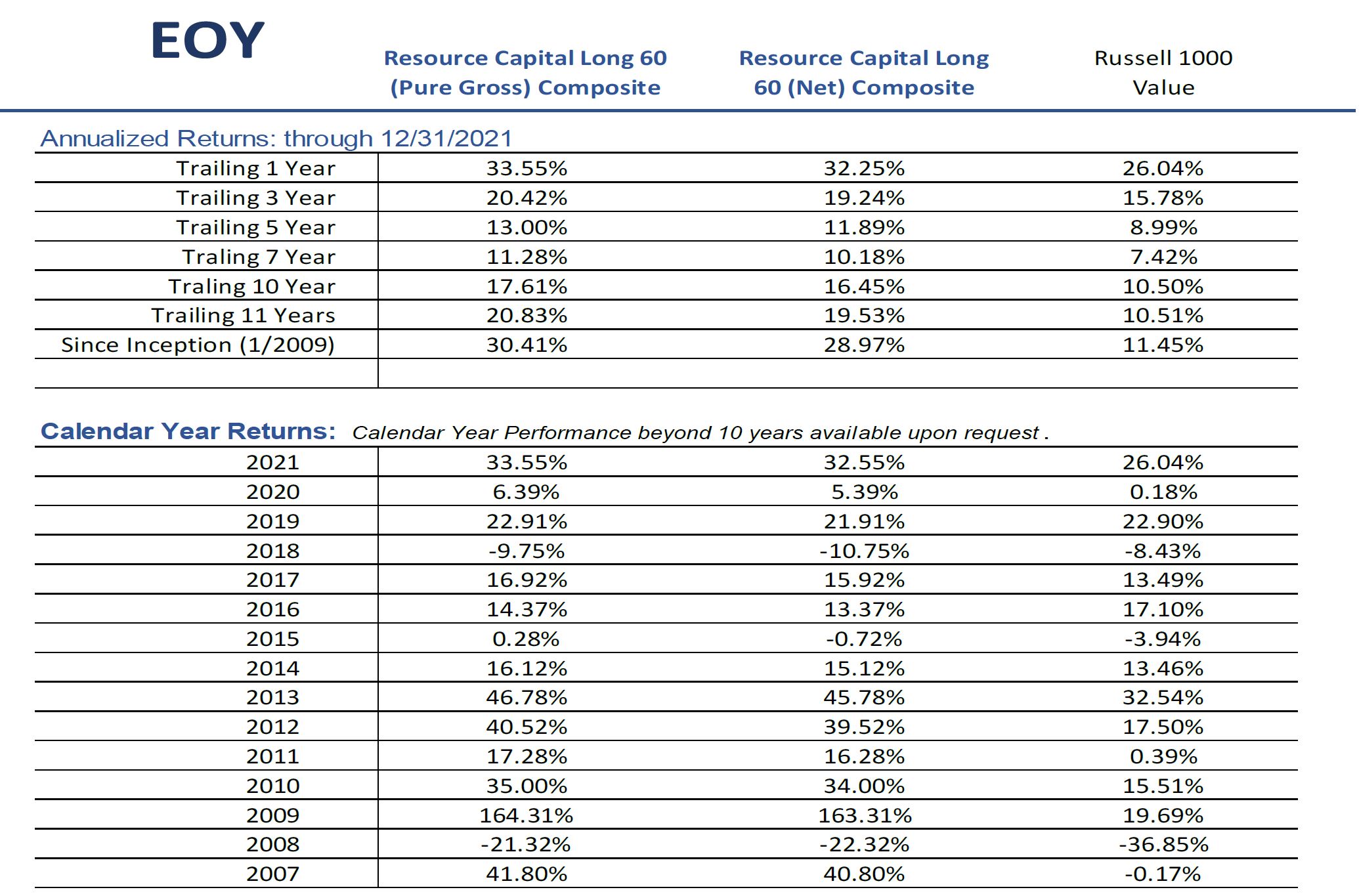

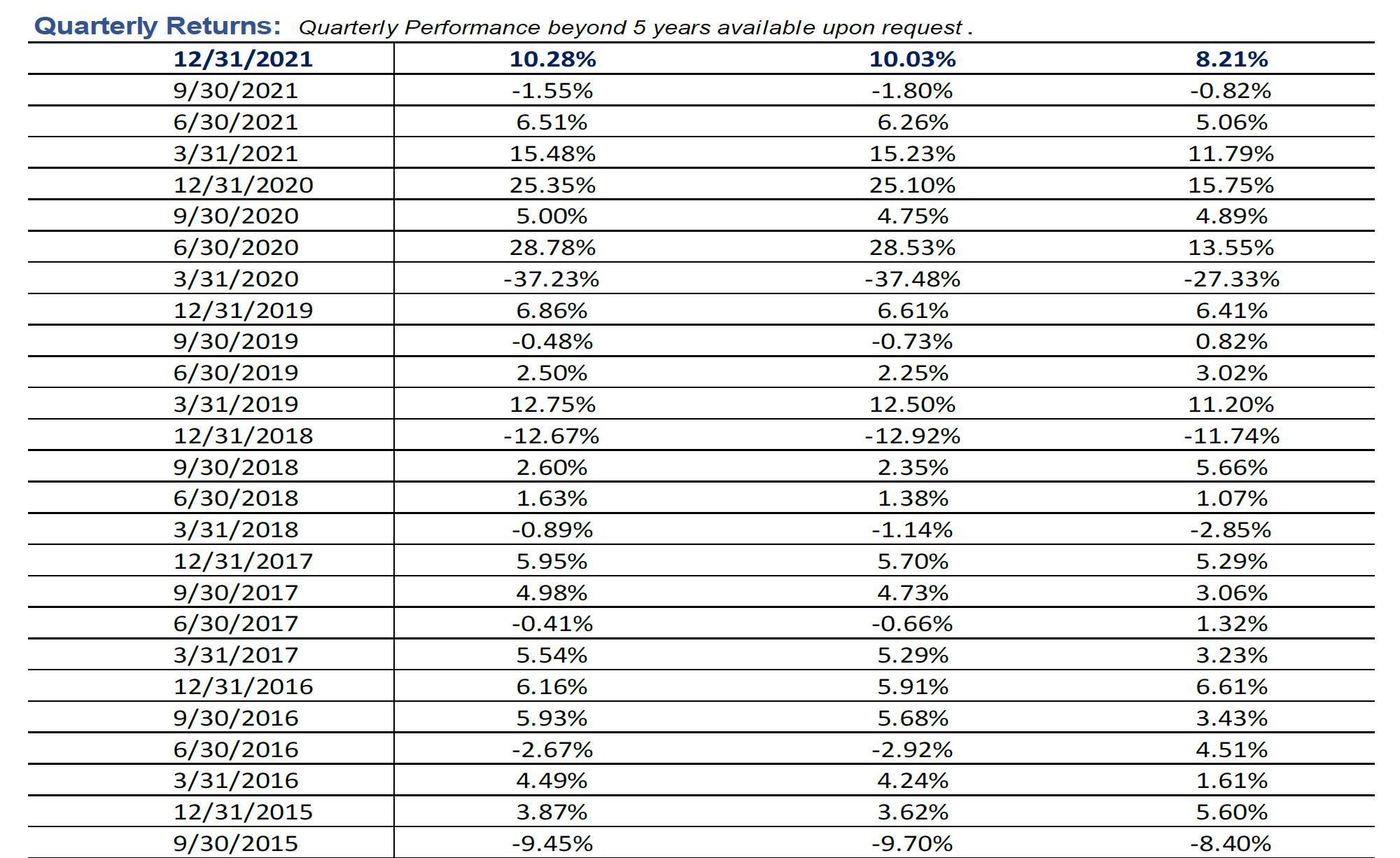

Performance Returns

RC LONG 60 VALUE

Source: Resource Capital Management. Past performance does not guarantee future results. Investments in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. None of the stock information, data and company information presented herein constitutes a recommendation by Resource Capital Management or a solicitation of any offer to buy or sell any securities. See important disclosures at the end of this document

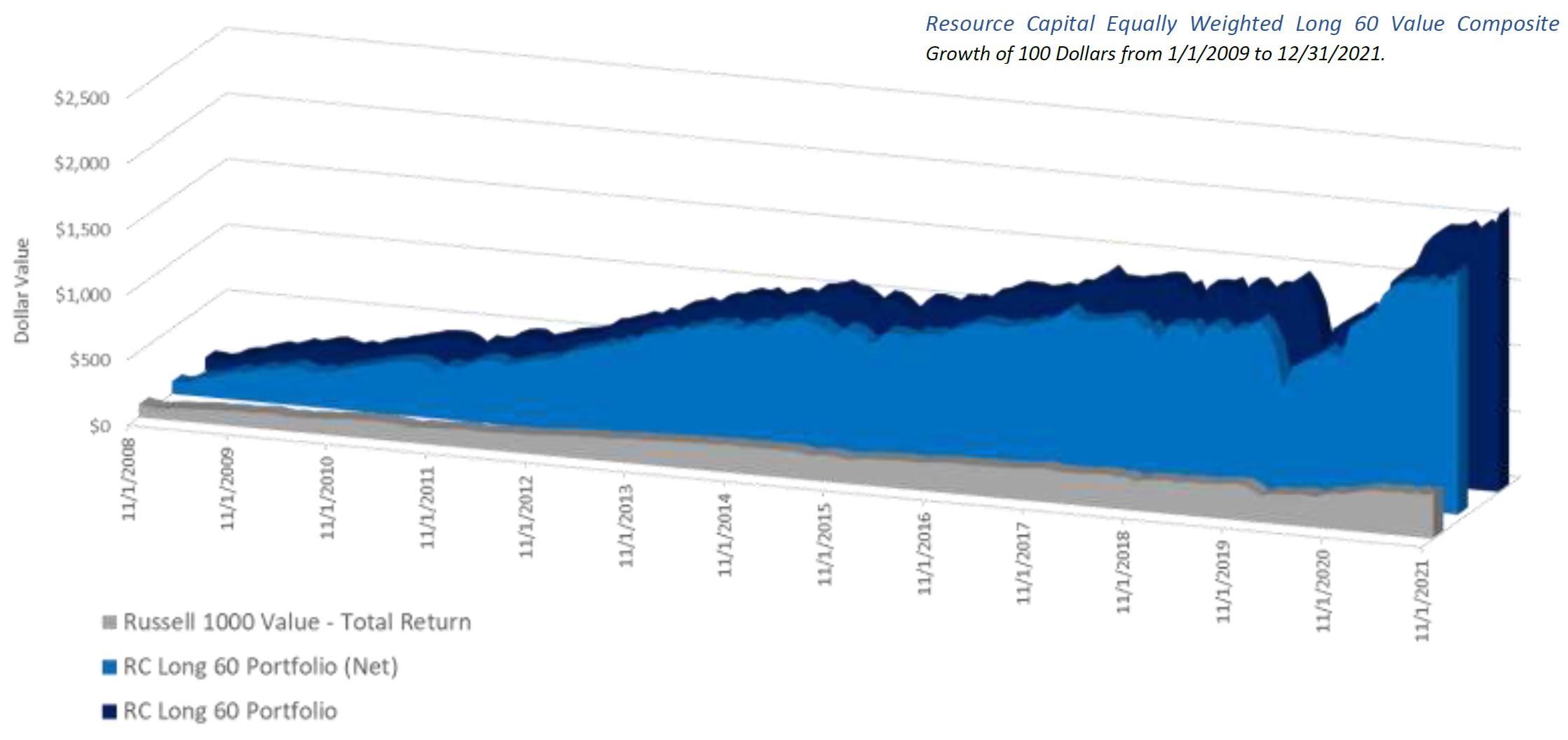

Supplemental Information

AS OF 12/31/2021

Resource Capital Equally Weighted Long 60 Value Composite Growth of 100 Dollars from 1/1/2009 to 12/31/2021

Graphs above are for illustrative purposes only. Past performance does not guarantee future results. Investments in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. None of the stock information, data and company information presented herein constitutes a recommendation by Resource Capital Management or a solicitation of any offer to buy or sell any securities. See important disclosures at the end of this document. The holdings identified do not represent all of the securities purchased, sold, or recommended for advisory clients and it should not be assumed that investments in securities identified were or will be profitable.

PERFORMANCE DISCLOSURE FOR THE RESOURCE CAPITAL EQUALLY-WEIGHTED LONG 60 VALUE MODEL PORTFOLIO

DISCLOSURE: Please read the important disclosure about the Company’s models at the bottom of this document. It will provide background information and additional detail on performance, the Company’s investment philosophy, approach, and methodology as well as measurement of risk and sources and description of the data that the Company uses.

The Resource Capital Equally Weighted Long 60 Value Model Portfolio has the following characteristics:

- The model portfolios are comprised of publicly traded equity stocks. The companies have a minimum market capitalization between $2 billion and $10 billion and are considered “mid- to large-cap” companies.

- The model portfolios reflect total return results.

- Concentration: All stocks in the portfolios are equally weighted within the portfolio and equally weighted across sectors.

- The investment objectives of the Resource Capital Equally Weighted Long 60 Value Model Portfolio are capital appreciation and value investing.

- The Company’s investment model is a static model that utilizes limitation filters to construct unique universes of equity securities which are segmented into specific sectors.

- Resource Capital has managed the model portfolio with the same investment philosophy it uses for client accounts.

Investment Returns

- The Investment returns include dividends and capital gains. Returns are net of Resource Capital’s maximum advisory fee of 1% of assets under management billed monthly (.0833%) or quarterly (0.25% per quarter). Returns for periods of less than one year are actual returns and returns for periods greater than one year are annualized returns.

Performance Disclosure:

The Resource Capital Equally Weighted Long 60 Value Model Portfolio Model Portfolio performance represents only the results of Resource Capital model portfolios. The model performance has inherent limitations. The returns shown are model results only and do not represent the results of actual trading of investor assets. Thus, the performance shown or discussed does not reflect the impact that material economic and market factors had or might have had on decision making if actual investor money had been managed. While model performance may have performed better than the benchmark for some or all of the periods shown, the performance during any other period may not have, and there is no assurance that model performance will perform better than the benchmark in the future. An investor's actual portfolio, composition and performance of the account may differ from those of the model portfolio due to differences in the timing and prices of trades, and the identity and weightings of securities holdings. Performance is calculated using a time-weighted rate of return using daily valuations and takes into account the reinvestment of dividends. Dividends are assumed to be paid at the ex-dividend date. Stocks are presumed added to, or deleted from, the model portfolio at the close of market on the day the change is made. The model performance reflects the deduction of a 1% advisory fee, but does not consider taxes and brokerage commissions, or other fees that investors may incur.

Benchmark Disclosure:

The benchmarks for the Resource Capital Equally Weighted Long 60 Value Model Portfolio are the Russell 1000 Total Return Index, the Russell 1000 Value total Return Index and the S&P 500 Total Return Index. The selected indices are not presented as appropriate benchmarks for the portfolios. The benchmarks are presented for illustrative purposes only. An index is an unmanaged, statistical composite and its return does not reflect payment of any brokerage commissions or fees an investor would pay to purchase the securities it represents. Such costs would lower performance. It is not possible to invest directly in an index. The benchmarks include a different number of securities and have different risk characteristics than the model portfolios. Past performance of the benchmark is no indication of future returns.

Russell 1000 Total Return Index

- The Russell 1000 Total Return Index measures the performance of the large-cap segment of the U.S. equity universe. A subset of the Russell 3000 Index, it includes approximately 1,000 of the largest stocks and represents approximately 90% of the U.S. market. The total return version reflects the effects of dividend reinvestment.

Russell 1000 Value Total Return Index

- The Russell 1000 Value Total Return Index measures the performance of the large-cap value segment of the U.S. equity universe and includes those Russell 1000 companies with lower price-to-book ratios and lower expected and historical growth rates. The total return version reflects the effects of dividend reinvestment.

S&P 500 Total Return Index

- The S&P 500 Total Return Index is an index of 500 stocks seen as a leading indicator or U.S. equities and a reflection of the performance of the large-cap universe. It is a market value weighted index and one of the common benchmarks for the U.S. stock market. The total return version reflects the effects of dividend reinvestment.

THE RISK OF LOSS: When making investments in equity securities, there is a risk that a portion or 100% of your investment funds could be loss. The Resource Capital Equally Weighted Long 60 Value Model Portfolio is an investment in equity securities.

Model Portfolios: The time period from December 31, 2009 to December 31, 2014 (Reviewed by Ashland Partners) and from January 1, 2014 to December 31, 2015 (Not Reviewed by Ashland Partners) disclosed in this document represent Model Portfolios ONLY. No actual investment was made in the Model Portfolios and therefore no assurances can be made as to the actual investment performance which could have been achieved. As such, any financial or performance calculations in this document utilizing data from December 31, 2009 to December 31, 2014 (Reviewed by Ashland Partners) and from January 1, 2014 to December 31, 2015 (Not Reviewed by Ashland Partners) are based solely on Model Portfolios and not Live Money Portfolios.

This document is presented for illustrative purposes only. Past performance does not guarantee future results. Investments in equity strategies involves substantial risk and has the potential for partial or complete loss of funds invested. None of the stock information, data and company information presented herein constitutes a recommendation by Resource Capital Management or a solicitation of any offer to buy or sell any securities. Please visit www.resourcecapitalmgt.com for more information regarding Performance Disclosures.

General Inquires